We need to get several inputs to calculate the PV of a company.

- Future Earnings Per Share - In this case we are going to calculate the expected earning per share 10 years from now:

The current EPS can be found on many different financial websites such as Reuters or Yahoo Finance. The estimated long term growth rate can be your own estimate or based on their historical growth rate. You could also find estimates from analysts on sites like NASDAQ.com or Reuters. The number 10 is the number of years under evaluation.

- Future Stock Price - using the calculated earnings per share we can calculate the future stock price.

The price earnings multiple used above could be the stock's current PE, an average of the last 5 years, or an estimated future PE.

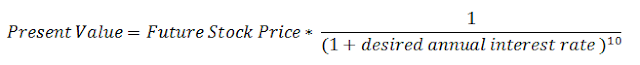

Finally, we get to the Present Value Formula:

Key Considerations:

The desired annual interest rate is the percentage you want to make annually from the investment. You want to see a of margin of safety when comparing the PV to the stock's current price. For example, if the calculated PV is half of the current stock price, it may indicate that the stock is cheap while if the PV is close to or less than the stock's current price there may not be much upside and greater risk to the downside. Note that the formulas as stated rely on a single EPS number. What if the EPS for the last 12 months was unusually high for the company? Clearly, other factors need to be considered like the company's financial health and earnings history. Perhaps you may want to use an average EPS for the last five or ten years rather than the current EPS.

No comments:

Post a Comment